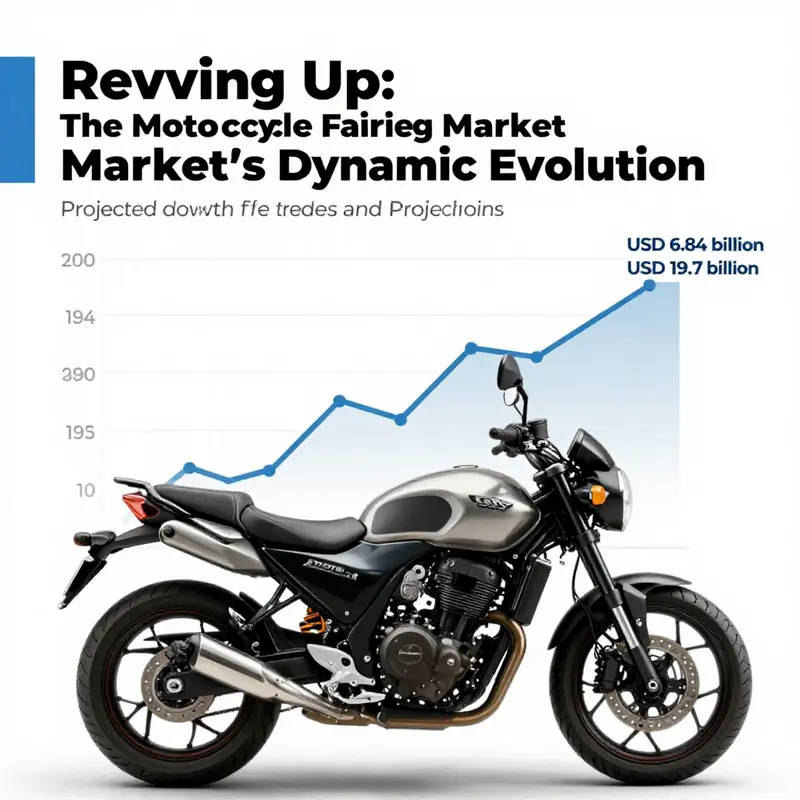

The motorcycle fairing market is witnessing exceptional growth, fueled by a surge in demand for customizations and enhanced performance. Valued at USD 6.84 billion in 2025, projections indicate it will reach approximately USD 19.7 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 12.82% through that period. This expansion is largely driven by consumer interest in high-performance, OEM-compatible fairings, particularly for popular models like the Honda CBR 600 F4i. The landscape is significantly shaped by manufacturers in China, primarily in Guangdong and Zhejiang provinces, known for their advanced production technologies and efficient supply chains. In addition to production dynamics, the aftermarket customization trend remains pivotal in influencing market growth, catering to an audience eager for personalization and performance enhancement. Each chapter will delve into these critical areas: growth trends, China’s supply chain role, and the impact of aftermarket customization, providing a comprehensive understanding of the current motorcycle fairing market.

Riding the Wave: How Global Demand for Motorcycle Fairings Is Redefining Performance, Customization, and Production Chains

A global market that once lived largely in the shadows ofOEM design and performance parts has emerged into the daylight as a living map of modern mobility. The motorcycle fairing market, long a niche of visual identity and wind-tunnel perfection, is now a dynamic, shaping force in how riders experience speed, style, and ownership continuity. The numbers tell a story of expansion: a valuation reaching into the mid-single-digit billions in the mid-2020s and a trajectory that points toward close to twenty billion dollars by the end of the forecast period. That trajectory is not a single thread but a braid of manufacturing prowess, consumer appetite, and technological progress. It binds together questions of aerodynamics with questions of aesthetic expression, and it does so across borders, supply chains, and the evolving expectations of riders who demand both performance and personal statement from their machines. In this landscape, the fairing is not merely a cosmetic shell. It is an engineered interface that mediates air, weight distribution, rider protection, and the potential for individualized branding of a ride. The market’s growth is, in essence, an indicator of a broader shift: motorcycling is increasingly treated as a platform for customization and performance, where the fairing serves as the primary canvas for that expression and the primary interface for how performance is realized in the real world.

The growth that underpins this canvas rests on several converging forces. First, the steady rise in motorcycle production furnishes a larger base demand for fairings, as more machines circulate through the aftermarket and into fleets that require maintenance and enhancement. Second, consumer interest in aerodynamic optimization—whether for track days, spirited street riding, or endurance commuting—drives demand for fairings that reduce drag, improve stability at high speeds, and accommodate cooling and airflow management. Third, the persistent hunger for aesthetic customization—color schemes, textures, finishes, and graphic treatments—continues to push riders toward replacements and upgrades that reflect personal identity as much as technical ambition. The result is a market that looks not only at fit and form but at the entire ride experience, from the moment a rider engages a throttle to the moment the curbside is reached and a custom look is admired in daylight or under streetlights.

From a market dynamics perspective, these drivers translate into a robust and diversified supply ecosystem. The base of production expands as manufacturers and suppliers invest in materials science, injection molding, and composite technologies that bring together lightweight strength, impact resistance, and compatibility with a wide array of mounting geometries. The evolution of materials—engineered polymers and fiber-reinforced composites that balance stiffness, flexibility, and resilience—enables fairings to withstand high-speed airflow while absorbing energy during minor impacts. These material advances are often paired with design innovations enabled by computer-aided engineering, wind-tunnel validation, and rapid prototyping processes. The upshot is a portfolio of fairings that offer more precise fit across models, longer service life, and a broader range of finishes, from matte to glossy, and from high-resolution graphics to textured surfaces thatdazzle under showroom lighting.

The manufacturing engine behind this expansion runs on clusters that are as strategic as they are technical. In a global production network, the most influential hubs for fairing production have matured around regions with deep polymer processing capabilities, sophisticated automation, and integrated logistics. Within this framework, high-volume clusters that leverage advanced polymer injection molding, automated painting systems, and tightly integrated supply chains yield economies of scale and speed. The proximity of bonded warehouses near export ports further enables efficient delivery models that minimize delays and allow for flexible incoterms that suit B2B buyers who must manage complex timelines across continents. In practical terms, this means faster replenishment cycles for distributors and retailers, lower inventory risk for aftermarket specialists, and shorter lead times for customers who expect on-time delivery alongside high-quality finishes. These advantages are amplified by the ability to offer Delivered Duty Paid (DDP) shipping, which removes customs surprises and accelerates retail readiness in regions like North America, Europe, and Australia. The net effect is a supply chain that feels tighter, more responsive, and more adaptable to the ebbs and flows of rider demand. For buyers seeking scalable sourcing with consistent quality and compatibility, this cluster-driven approach represents a compelling competitive advantage.

The market’s expansion is not purely a function of production scale. It is also driven by a strategic rethinking of fairing design for compatibility with a broad spectrum of OEM and aftermarket systems. Riders increasingly demand mount-friendly components that bolt on without extensive modification. They want fairings that not only confer aerodynamic benefits but also retain or enhance protection for the rider and the motorcycle’s critical systems. This demands engineering rigor: precise tolerances, durable finishes, and coatings that resist UV exposure, chemical solvents from windshields and bug splats, and routine cleaning regimes. It also means connectors and fastener systems designed to minimize installation time while maximizing strength. In this sense, the fairing becomes a modular, upgradeable subsystem rather than a one-off component. The market responds with multi-part panels, clip-and-go attachment schemes, and built-in channels for integration with sensor housings and light assemblies, all while maintaining the clean lines and streamlined profiles riders expect.

From the rider’s perspective, this confluence of performance and personalization speaks directly to the evolving culture of motorcycling. The fairing represents a space where function and style converge, where a rider can tune aerodynamic efficiency and wind protection, while simultaneously shaping the machine’s visual language. The advent of high-definition finishes, premium textures, and digital-printed graphics has made the aesthetic dimension of fairings as important as the structural or aerodynamic aspects. It is not merely about changing the color or tone of a bike; it is about articulating a narrative—one that communicates speed, intent, and a sense of belonging to a community that values both engineering excellence and unique expression. This dual demand for performance and identity drives a broad cross-section of consumers to engage in aftermarket upgrades, pushing forward the overall market momentum and expanding opportunities for suppliers who can offer combinations of fit, finish, and functional enhancements.

A critical thread in this evolving fabric is the role of model-agnostic and model-adaptable solutions. Riders want fairings that can be adapted to a variety of frame geometries and mounting schemes without sacrificing the integrity of the original design or the appearance of a seamless, factory-like finish. This pushes manufacturers to develop standardized mounting interfaces and universal fastener sets, as well as modular panels that can be swapped with minimal effort. The pursuit of interoperability in fairing design helps reduce the barriers to entry for customization, making it easier for a rider to upgrade a bike without committing to a bespoke, one-off part that is difficult to source in the future. In practice, this has implications for the supply chain as well. Standardized interfaces can simplify production and inventory management, reducing the complexity of supporting a broad catalog of SKUs and enabling faster response times to shifting consumer preferences. The interplay between standardization and customization is a defining feature of the current period, shaping how manufacturers and retailers plan their product lines and how they communicate with riders about what is possible within a given budget or performance target.

The chapter’s data points paint a picture that aligns with broader industry narratives about globalization and specialization. China, with its large, mature polymer processing sector, continues to play a central role in the production of fairings. The Guangdong and Zhejiang provinces stand out for their clustering of suppliers and their access to advanced manufacturing technologies. The factories in these regions leverage automated painting systems and sophisticated supply chains to deliver consistent quality with rapid cycle times. The presence of bonded warehouses near key export ports such as Nansha and Shekou supports streamlined logistics, enabling DDP shipping that appeals to buyers who require predictable landed costs and a simplified import process. This combination of capabilities makes it possible for B2B buyers to source high-quality fairings at competitive costs while maintaining reliability and efficiency across a global distribution network. In other words, the economics of scale pair with the reliability of high-quality finishes to create a compelling value proposition for both manufacturers and retailers in the aftermarket segment.

Amid these structural advantages, the market’s growth is also shaped by consumer expectations around durability and repairability. As riders face more demanding riding environments and longer inter-service intervals, the need for fairings that resist impact, abrasion, and environmental wear becomes more pronounced. This translates into a preference for materials and construction techniques that can sustain repeated exposure to sun, rain, and road salt without compromising aesthetics or fit. It also emphasizes the importance of repairability: in the event of damage from a fall or collision, the ability to replace individual panels without a complete fairing assembly reduces downtime and keeps riders on the road. The trend toward modular, serviceable components helps extend the lifecycle of fairings and supports more sustainable consumption patterns within the market.

Looking across regional markets, it is clear that demand is not confined to a single geography. North American hobbyists and professional riders alike seek performance-oriented fairings that pair aerodynamics with robust protections. In Europe, riders often balance high performance with a strong emphasis on style and color customization, reflecting a broader culture of personal expression through motorcycles. In Asia and the Pacific, growth is fueled by expanding urbanization, rising disposable income, and a growing enthusiast community that values both speed and the artistry of fairing design. This geographic diffusion reinforces the importance of a flexible, resilient supply chain that can serve diverse markets with consistent quality and rapid fulfillment. The capacity to tailor configurations to local preferences—whether that means different heat management solutions, venting patterns, or finish options—further strengthens the value proposition for producers and distributors operating on a global scale.

For buyers navigating this landscape, supplier selection hinges on a handful of crucial criteria. Beyond price, the ability to deliver reliable, OEM-compatible solutions matters most. Consistency of quality ensures that a fairing integrates cleanly with the rest of the bike and does not introduce misalignment or mounting complications. On-time delivery influences planning, inventory management, and the ability to meet market demand without stockouts. Technical compatibility, including the fit with existing frame geometries and the ability to accommodate sensors or auxiliary equipment, is essential for maintaining the overall performance envelope of the motorcycle. In short, the modern fairing supplier is not just a parts provider but a technical partner who contributes to both the reliability and the expressive potential of the rider’s machine.

This environment also invites a broader dialogue about the value chain and the future of aftermarket partnerships. Strategic sourcing from major manufacturing clusters offers a competitive edge in terms of cost efficiency and scalability, while collaboration with designers and engineers can accelerate the translation of rider insights into tangible products. It is a collaboration that rewards transparency, clear communication, and a shared commitment to quality. When a supplier demonstrates a proven capacity to deliver high-quality, compatible fairings on schedule, the relationship evolves from a simple transaction into a strategic alliance that underpins a brand’s reputation and a retailer’s ability to satisfy customers who demand both performance and personal expression.

Against this backdrop, one can observe a market that is mature enough to support sophisticated product development, yet dynamic enough to welcome new entrants who bring fresh ideas about materials, finishes, or modularity. The fairing is no longer a static appendage to the motorcycle; it is a core platform for performance optimization, consumer customization, and international trade. The growth trajectory—anchored by a robust 12.82 percent compound annual growth rate from 2026 to 2033 and a projected market value approaching 19.7 billion USD by the end of the period—reflects this multifaceted momentum. It signals not only an expansion of demand but also a maturation of the ecosystem that makes it possible for riders to express themselves through their machines, for manufacturers to scale with confidence, and for retailers to coordinate global supply chains that are responsive to a wide array of markets and preferences. In this sense, the motorcycle fairing market embodies a convergence of science, craft, and commerce, where aerodynamic performance, visual storytelling, and logistical efficiency all ride together toward a shared horizon.

For readers who wish to explore the breadth of aftermarket options and the way they intersect with model families and rider ambitions, a catalog of category options can provide a useful reference point to gauge how a given fairing choice might align with both technical requirements and aesthetic goals. A practical way to engage with this landscape is to consider the 2023new category as a living snapshot of contemporary design language, material choices, and finish options that are currently shaping the marketplace. This reference point can serve as a starting place for conversations with suppliers, designers, and retailers who are looking to translate rider preferences into ready-to-ship products that are compatible with a wide range of bikes and riding styles. 2023new fairings can serve as a useful illustration of how modern fairings balance form and function in ways that resonate with today’s riders.

As the market continues to unfold, the story remains anchored in a few simple truths: riders want to move faster with less wind resistance, they want long-lasting finishes that endure sun and rain, and they want the freedom to express themselves through the look and feel of their machines. The fairing sits at the center of these ambitions, a tangible interface between rider and machine that amplifies performance while serving as a canvas for personal narrative. The supply chain must keep pace with this ambition, delivering high-quality, compatible products on time, every time, and in a way that respects the environmental and regulatory realities that govern manufacturing and distribution today. In doing so, the industry reinforces a broader trend toward customization as a standard of ownership rather than a luxury add-on, cementing the fairing’s place as a vital enabler of both performance and identity in the global motorcycle economy.

External reference: https://www.mordorintelligence.com/industry-reports/motorcycle-fairing-market

China’s Role as the Forge: How a Manufacturing Corridor Shapes the Global Motorcycle Fairing Market

The motorcycle fairing market has matured into a high-stakes arena where design ambitions meet the hard realities of supply chain dynamics. In this setting, the Guangdong corridor — with its capital in Guangzhou and Foshan and its outward reach into broader regional networks — functions as a supercharged workshop that links the earliest stages of design to the final act of delivery. It is here that thousands of factories convert raw polymers into exact shapes through advanced injection molding, where UV resistant coatings overlay color and gloss with a durability that resists the wear of road salts and sunlight, and where automated painting lines encode consistency into millions of units. What makes this ecosystem so effective is not merely the existence of facilities but the depth of integration across the production chain. These cities host an almost seamless sequence of capabilities that flow from molding to finishing to assembly, enabling manufacturers to produce fairings that carry a high fidelity to original equipment during fitment, while also accommodating aftermarket alterations that many riders crave. The impact on lead times is tangible. When a project benefits from this level of integration, the time from concept to curbside can be markedly shorter than in markets where suppliers rely on a patchwork of subcontractors. In practice, the lead times can be up to 45 percent faster, a difference that matters when models are refreshed, when inventory is tight, or when custom runs arise from a retailer asking for a limited edition feel without sacrificing reliability. The practical effect is a faster cycle for innovation, slower cycles of risk, and a smoother path to market for teams that must coordinate development across multiple markets with disparate regulatory expectations and mechanical standards.

Logistics complete the picture. Guangdong’s manufacturing districts are supported by a network of bonded warehouses positioned near major export gateways such as Nansha and Shekou. This proximity is not a mere convenience; it unlocks streamlined logistics options that have a direct impact on cost structures and delivery reliability. For international buyers, the ability to arrange DDP, Delivered Duty Paid, eliminates a layer of postpurchase friction. Instead of negotiating duties and taxes on arrival, buyers can plan on a single landed cost that aligns with their internal procurement processes. This simplification is particularly valuable for distributors who manage cross-border sales or for workshop networks accustomed to predictable pricing. The warehouse configurations also provide a buffer against volatility in demand. When a spike in orders occurs for a popular design or when a batch must be coordinated with shipping windows tied to port congestion, the ability to draw from bonded inventories reduces the risk of delayed projects and missed market opportunities. It is this fusion of manufacturing discipline and logistics efficiency that underwrites the prestige of sourcing from this part of China and explains why the APAC region commands a dominant share of the global market.

The market projections align with this regional strength. In 2025, the global motorcycle fairing market was valued at around 6.84 billion US dollars, with a compound annual growth rate of roughly 12.82 percent projected from 2026 to 2033. By the end of the forecast period, estimates place the market well into the high tens of billions, underscoring the sustained demand for durable, aesthetically compelling, and technically compatible fairings. This growth is not random; it reflects a convergence of consumer preference for customization, a rising interest in performance enhancements, and the ability of modern economies to instrument faster cycles of design refinement and production. A key facet of this expansion is the Asia Pacific region, which maintains a commanding position with roughly a majority of market activity centered in China and adjacent manufacturing centers. Within this regional framework, the share held by China and its export capabilities continues to expand, bolstering the central thesis that manufacturing prowess, coupled with strategic logistics and scale, serves as a powerful engine for market growth. The result is a market that invites continued investment in machinery, automation, and workforce capabilities in the Guangdong corridor and beyond.

From a sourcing standpoint, the logic is pragmatic and wide in scope. Buyers seeking to balance cost, speed, and quality find that the Chinese ecosystem offers an unusually favorable alignment of these factors. The vertically integrated nature of numerous facilities enables end-to-end production without requiring excessive coordination across independent suppliers. In practice, this means that a single vendor can manage a project from raw material selection through the final paint job and optional protective coatings. The reduction in supply chain friction is not merely about speed; it is about predictability. The ability to forecast production windows with confidence supports more accurate budgeting, better inventory management, and fewer surprises when orders are scaled. For B2B buyers, this translates into less risk and more assurance that a given design can be reproduced consistently, a crucial factor when dealing with models that demand exact fitment and cosmetic fidelity across thousands of units.

The strategic advantage provided by this region feeds directly into the operations of global distributors and aftermarket retailers. A central consideration is the balance between standardization and customization. The core fairing profile must align with mass-produced frames and mounting points to ensure OEM compatibility and efficient replacement. Yet riders increasingly seek unique colorways, textures, and finishes that reflect personal style or align with a brand’s aesthetic language. The Guangdong ecosystem is well positioned to support both ends of this spectrum. The same foundational tooling and process controls that guarantee repeatability for OEM-like components can, with relatively modest adjustments, accommodate bespoke color palettes or surface textures. This dual capability is essential in sustaining growth for a market that thrives on both reliability and differentiation. It also sharpens the appeal of a coordinated sourcing strategy: buyers who can synchronize design intent with a supplier’s manufacturing cadence stand the best chance of delivering timely products that satisfy diverse customer expectations without compromising on fit or performance.

This is where the concept of strategic sourcing from China gains practical traction. The conversation is not simply about price per unit but about total cost of ownership, which includes lead time, quality management, and the ability to scale. Platforms that connect buyers with verified manufacturers play a crucial role in reducing information asymmetry and lowering procurement risk. In a market where a single run of a few thousand units can hinge on a precise color batch or a narrowly specified coating system, the reliability of the supplier network matters as much as the price discipline. For practitioners in the field, the takeaway is clear: a well-curated supplier base in this region can deliver predictable performance, consistent quality, and timely delivery, all of which are essential to maintaining customer satisfaction and meeting the expectations of a growing aftermarket ecosystem.

Within this broader supply chain narrative, it is important to acknowledge the design and materials landscape that underpins fairings. The core material class remains plastics produced through sophisticated polymer injection molding. The precision of these processes supports tight tolerances, smooth surface finishes, and the resilience required to withstand the rigors of road use. Overlaying coatings, including UV-resistant layers, extends the longevity of the finish and helps preserve color integrity through years of exposure to sun and weather. Automating the painting process at scale contributes to uniform appearance across large batches, a factor that reduces variation in color and gloss that could otherwise undermine perceived quality. All of these capabilities reside in a manufacturing economy that prioritizes transfer efficiency, from mold design through to finished product. The result is a family of products that not only meets functional needs but also carries a consistent aesthetic that riders and shop owners come to expect as standard.

Of course, the global market is not without its challenges. The same scale that creates reliability can also create dependencies. A significant portion of the world’s fairing production flows through this region, which underscores the importance of risk management strategies such as supplier diversification, contingency planning for port disruptions, and investment in redundancy within the logistics network. Yet the resilience of the Guangdong corridor stems from its breadth and depth. The concentration of capabilities across thousands of factories means that when one line is temporarily paused for maintenance or when a single facility encounters a raw material constraint, other nearby operations can often absorb the slack. In practice, this translates into a more stable supply picture than could be achieved in more geographically dispersed models. For buyers charting the course of a long-term sourcing program, this resilience is a compelling argument in favor of maintaining an anchored supplier network in the China heartland while building complementary relationships in other regions to hedge risk and broaden design possibilities.

The chapter closes by returning to the strategic implications for the broader market. The China-led supply chain is not a dead end but a springboard for the entire fairing ecosystem. It provides the foundation for mass customization without sacrificing the reliability and speed that customers increasingly demand. It enables a level of design iteration and production discipline that can drive improvements across the board, from fitment accuracy to surface durability. It supports a dynamic where high-quality, OEM-compatible fairings can coexist with an expanding menu of aftermarket offerings. In other words, the region’s manufacturing core does not merely supply products; it helps shape how the market defines value, quality, and speed. For manufacturers and distributors seeking to navigate the complexities of scale and customization, the Guangdong corridor offers a practical blueprint for sourcing that emphasizes integrated capability, efficient logistics, and predictable delivery as the pillars of sustainable growth.

As readers look toward the future, the implications are clear. The global motorcycle fairing market will continue to lean on the mature, deeply integrated supply chains of this region, while also encouraging the development of complementary hubs that diversify risk and broaden design latitude. The ongoing investment in advanced molding technologies, robust coating processes, and automated finishing lines will keep the region at the forefront of the industry. For traders and designers alike, the lesson is simple: to translate bold design ambitions into reliable, market-ready products, they will routinely turn to a manufacturing corridor that demonstrates how scale and sophistication can align to produce high-performance fairings that meet the exacting standards of riders worldwide.

In this sense, the chapter’s focus on China’s role is not about a single dominant actor but about a proven model of industrial precision that informs and inspires the entire market. The journey from concept to curbside is smoother when the route passes through a tightly integrated ecosystem that blends engineering excellence with logistical sophistication. The convergence of polymer science, automated finishing, and strategic warehousing near major ports creates an operating environment where high-quality fairings can be produced at scale and delivered with confidence. The market may be global, but its beating heart is distinctly regional, driven by a corridor that has learned how to turn complexity into consistency and speed into value. This is the essence of China’s central role in the motorcycle fairing supply chain, a role that will continue to shape the trajectory of the global market for years to come. Honda fairings can be seen as a case study in how OEM-compatible design translates into reliable aftermarket options, a path that many manufacturers and distributors will follow as they navigate evolving customer expectations and a growing appetite for customization.

External resource: https://www.made-in-china.com/products/101971248477.html

Riding Style Redrawn: How Aftermarket Fairings Are Reshaping the Global Motorcycle Market

The aftermarket customization trend is a principal force shaping the global motorcycle fairing market. Riders pursuing more than a shield from wind demand a synthesis of style, performance, and practicality, and purpose-built aftermarket fairings deliver on that promise. This shift is not a fleeting subculture but a movement that redefines ownership, maintenance, and identity for modern riders. As demand grows, manufacturers and suppliers are pressured to deliver products that fit precisely, perform reliably, and endure the rigors of real-world riding. The market has expanded beyond a niche segment to a mainstream ecosystem where choice, quality, and fit matter as much as speed and aesthetics. This momentum is visible across retailers, logistics networks, and the service ecosystems that accompany performance upgrades.

The emotional and social dimensions of customization are powerful drivers. In a world where social media amplifies visual identity, riders increasingly view their motorcycles as canvases for expression. The ability to design color schemes, logos, artwork, and specialized finishes translates into a personal manifesto on two wheels. This is not purely about looking unique; it embeds a sense of belonging to a community and lifestyle. Market leaders recognize this, delivering products that balance bold aesthetics with manufacturability and durability. The result is a space where artistry and engineering practicality meet, and riders expect both style and measurable performance benefits to align.

From a technical standpoint, aftermarket fairings today offer tangible benefits beyond decoration. When engineered for models with high demand for efficiency, well-designed fairings can streamline airflow around the bike, reducing drag while preserving or even enhancing stability at speed. The improvements translate into crisper throttle response, potential gains in fuel efficiency, and a more predictable feel at the bars and through corners. For riders who push their machines in spirited riding or track-inspired sessions, the aerodynamic gains also contribute to steadier handling and reduced fatigue on longer rides. Modern fairings also address heat management, guiding heat away from critical components and improving rider comfort during long sessions or dense urban traffic.

Material choices have evolved with performance needs. ABS plastics continue to form the backbone of many aftermarket panels because of their resilience and cost efficiency. Carbon fiber remains a premium option for selective panels or accents where stiffness-to-weight and high-end aesthetics matter most. The resulting portfolios offer a spectrum of price points and performance profiles, enabling riders to tailor upgrades to use case, budget, and visual preference. Durability under heat, moisture, grit, and abrasion helps explain why aftermarket fairings have matured from cosmetic add-ons into essential components for enthusiasts who demand reliability alongside style. The integration of these materials is supported by manufacturing ecosystems optimized for precision and repeatability, ensuring fairings not only look good but fit correctly and function as intended.

The supply-chain story is central to growth. Global manufacturing clusters—especially in major production hubs—provide volume, consistency, and speed that aftermarket buyers expect. China remains a dominant production hub, with mature clusters around Guangdong and Zhejiang that excel in polymer processing, injection molding, painting, and end-to-end quality control. These regions offer capabilities that translate into faster delivery times, scale, and competitive pricing, strengthening the resilience of the aftermarket market. The proximity of bonded warehouses near export ports and the ability to deliver Delivered Duty Paid (DDP) are strategic advantages that reduce friction for retailers and workshops, allowing them to focus on fit verification and conversion quality.

Digital procurement is reshaping how buyers source these components. B2B platforms connect buyers with capable suppliers who can deliver precision-engineered parts within tight lead times. In the current ecosystem, sample lead times of about a week or two and bulk-order lead times of two to three weeks are common. Such timelines enable rapid prototyping, fast iteration, and swift introductions of new designs in response to evolving rider preferences. The speed to market enabled by digital procurement helps sustain the customization cycle, ensuring design breakthroughs and aesthetic trends remain fresh without stalling on the factory floor or in transit. This environment supports a marketplace where creativity can meet capability in near real time, expanding the breadth of available styles and finishes while preserving fit and performance.

Across the spectrum of designs, compatibility and fit remain foundational. The most successful aftermarket lines are designed around existing mounting points and wind-tunnel-informed shapes that preserve the bike’s original geometry and handling dynamics. This is not an afterthought but a baseline expectation, as riders and shops seek solutions that install quickly, require minimal modification, and maintain the integrity of the machine. The emphasis on precise fit, material quality, and airflow optimization helps sustain trust among a discerning customer base and reinforces the perception of aftermarket fairings as true extensions of the bike rather than disposable add-ons. The breadth of catalog offerings—from stealthy matte finishes and race graphics to retro colorways and art-driven textures—helps meet a wide range of aesthetics while maintaining performance thresholds.

The market’s growth is supported by a broader and more diverse consumer base. Enthusiasts, amateur racers, and daily riders alike are drawn to the value of a practical upgrade that complements style. Some riders pursue changes to improve accessibility for maintenance, cooling, or serviceability, while others seek daily mood-lifters that reinforce their identity. This convergence expands the addressable market and creates steady demand for both performance-oriented pieces and visually distinctive designs. Retailers who curate balanced offerings can continue to grow by aligning catalog breadth with dependable delivery and consistent quality.

In this ecosystem, suppliers, manufacturers, and retailers coordinate to deliver a reliable, scalable product pipeline. The most successful partners combine manufacturing excellence with responsive logistics, ensuring that customers across continents receive products that fit their bikes and perform as promised. In summary, aftermarket customization has moved beyond a niche pastime to a dominant market force, blending emotional resonance with measurable performance gains and a robust manufacturing and logistics infrastructure. The fairing becomes a functional, identity-defining component that reshapes how riders perceive and experience their motorcycles.

For readers seeking a concise guide to evaluating aftermarket fairings on fit, material quality, and airflow performance, practical resources exist to help compare options and make informed choices. External references can provide structured criteria for assessing fit and durability across brands.

Final thoughts

The motorcycle fairing market exemplifies growth driven by consumer demand, technological advancements, and personalization trends. As the market expands towards an estimated USD 19.7 billion by 2033, businesses must understand the dynamics at play, particularly the pivotal role of manufacturers in China and the influence of aftermarket customization. By aligning sourcing strategies with these trends, business owners can navigate this promising landscape effectively and maintain a competitive edge in the evolving motorcycle industry.