Maier Manufacturing stands at the forefront of motorcycle fairings, providing a wide selection of aftermarket parts known for their guaranteed fit with major brands. With an increasing number of riders seeking to replace or upgrade their motorcycle fairings, it’s crucial for business owners to understand the different types offered, their material compositions, and the economic implications of their production. This article will delve into the various fairing types available, the materials that make them durable, the economic impacts of their production, the intricate supply chain dynamics, and the trends toward customization and aftermarket products. Each chapter contributes to a holistic understanding of Maier motorcycle fairings, setting a solid foundation for informed business decisions.

Maier Fairings Unveiled: Navigating Types, Materials, and the Rider’s Performance Frontier

The silhouette of a modern motorcycle is defined as much by its wind deflection as by its paint, and the fairing is the most expressive instrument in that dialogue. Maier Mfg. has built a reputation around motorcycle and scooter fairings, plastic parts, and body kits that aim to blend fit, finish, and function. When a rider shops for a Maier fairing, they are not just choosing a shell; they are selecting a strategy for aerodynamics, protection, and personal style. The fairing becomes a practical instrument for controlling air flow, a shield against road spray and debris, and a canvas on which a rider can imprint their own narrative of speed and control. In this sense, Maier fairings are more than aftermarket add-ons; they are midlife upgrades for machines that deserve to look and feel like new, even years after leaving the showroom floor.

Maier’s catalog is notable not only for breadth but for a practical promise that speaks directly to riders who want reliable compatibility. On platforms where Maier’s products are sold, the emphasis is on guaranteed fit for specific brands and models. This is not a mere marketing line. It translates into fewer surprises after the box is opened, smoother installation, and a higher likelihood that the shell will align with the bike’s mounting points, lighting positions, and paint schemes. It is a practical commitment that matters to anyone who has ever spent evenings aligning a windscreen, re-soldering a wiring harness, or masking off a panel to avoid paint mismatch. The combination of broad selection, competitive pricing, and a spectrum of finishes and textures makes Maier a reliable starting point for riders who want to refresh a bike without surrendering performance.

When Maier segments its offerings, it mirrors how riders actually experience the road. Full fairings cover the engine and most of the frame, delivering the most complete aerodynamic profile and the strongest wind protection. They suit sport bikes and riders who spend long hours in the saddle at elevated speeds, where every gram of weight and every curve of the shell matters. Half fairings strike a different balance. They provide substantial coverage while revealing more of the bike’s personality and mechanicals, a preference common on naked bikes and standard machines where maneuverability and a lighter look carry equal appeal. Quarter fairings, the smallest of the trio, wrap the front end around the headlight and a slender slice of upper bodywork. They are chosen for style, quick swaps, or model-specific experiments that don’t require a full shell.

In addition to these standard forms, Maier’s lineup embraces custom or aftermarket fairings. These offerings broaden the spectrum with unique shapes, graphics, and materials that reflect a rider’s individual taste. The result is a landscape where you can pursue a race-inspired look, a retro aesthetic, or a clean, minimal appearance, all while maintaining the kind of fit and protection that matter on real roads. The practical truth is that a rider’s preference for coverage, weight, and installation complexity often converges on a single path: the choice is a negotiation among protection, weight, aesthetics, and ease of mounting.

Material choice sits at the core of this decision. Modern aftermarket fairings can rival OEM components in strength and resilience when they use advanced plastics and coatings. ABS remains a common baseline because of its rigidity, impact resistance, and ease of molding. Yet the market has evolved. Many high-quality aftermarket pieces incorporate layered surfaces, UV-protective coatings, and precise tolerances that align with factory lines. The weight difference between a well-engineered aftermarket shell and an aging original part can be surprisingly small, while durability and color retention improve with better finishes and paint compatibility. For riders, this means that choosing Maier or other reputable aftermarket brands does not require sacrificing quality; it can be a deliberate upgrade in aesthetics and performance without excessive cost.

Compatibility is the hinge point of installation and long-term satisfaction. The most effective purchase is one that aligns with the exact make, model, and year of the motorcycle. When alignment occurs, installation becomes straightforward, paint matches are easier, and lighting apertures line up with precision. The guarantee of fit that accompanies listings is more than a marketing promise; it reduces post-purchase friction and lowers the risk of returns due to misfit. Yet a wise buyer still plans for more than a simple shell. New mounting tabs, grommets, or even a different windscreen or subframe attachment may be required. Maier’s breadth supports many options, but a careful check against the vehicle’s brand and model remains essential to avoid misalignment down the line.

Riding style and climate further color the decision. In hot and sunny zones, a full fairing can dramatically reduce rider fatigue by shaping a calmer microclimate around the torso and arms. In cooler regions, a lighter shell or even an open cockpit can be preferable for feel, ventilation, and the ability to monitor temperatures at critical points like the fork or wheels. Maintenance considerations also matter. Fairings endure heat cycles, UV exposure, and occasional impacts. The right choice balances weather resistance, ease of cleaning, and the ability to withstand repeated sun and heat cycles without paint crazing or warping. In short, the rider’s environment and habits create a practical map to guide the selection among full, half, or quarter shells.

From a manufacturing standpoint, Maier’s presence can be understood through its connection to the broader ecosystem of aftermarket plastics. Guangdong and Zhejiang in China anchor major clusters for fairing production. Guangdong, in particular, has developed a mature ecosystem around polymer injection molding, UV coating technologies, and automated paint production. The regional network supports high-precision manufacturing and rapid turnarounds, aided by vertically integrated supply chains that help shorten lead times. This is not merely a geographic footnote; it is a logistical backbone that supports consistent availability, paint quality, and the ability to offer a wide spectrum of finishes. For riders who want to refresh a bike mid-season or after a mishap, these capabilities translate into shorter downtime and a smoother transition from box to road.

The market’s scale in Guangdong helps explain why Maier and similar brands can offer a broad line with multiple finish options. The capacity to produce at scale supports more uniform color matches, consistent thicknesses, and tighter tolerances across a wide range of models. Distribution channels—from regional factories to ports like Nansha or Shekou—enable direct, duty-paid delivery to North America, Europe, and beyond. A robust supply chain also supports the development of new colors, textures, and graphics that align with current design trends without sacrificing the ease of replacement that riders rely on. All these factors combine to produce a shopping experience where a rider can choose not only a practical shell but a shell that feels prepared for the road ahead.

In practice, the fairing you select is a tool for shaping the machine’s character. A full fairing is a commitment to a more enclosed silhouette and a refined aero profile; a half fairing preserves a sense of the bike’s naked essence while offering practical wind protection; a quarter fairing introduces a focused silhouette around the headlight while inviting a personalized aesthetic that can range from minimal to bold. The installation journey is rarely a purely cosmetic one. It involves aligning mounting points, ensuring that the inner structure supports the shell, and verifying that the chosen finish can hold up under the sun, dirt, and road salt common to daily riding. The craft of fitting a Maier shell becomes a small test in patience, measurement, and paint-matching, a process many riders come to enjoy as part of the ride’s ritual.

For riders who want to explore beyond Maier while staying within the same family of aftermarket options, a broader look at the market can illuminate the balance between fit, finish, and function across brands and models. The Honda fairings category offers a representative glimpse of how different bikes—sport machines, naked bikes, and standard commuters—translate the same concept into distinct silhouettes and materials. It is a useful compass for riders seeking to understand how a single approach to fairings can morph across a variety of motorcycles, yielding a personalized blend of protection and style. See more in the Honda fairings category.

The science behind the shells also deserves a nod. ABS remains the workhorse for many fairings because of its consistent performance in impact resistance, surface finish, and compatibility with paint systems. The development of coatings, as well as refinements in bonding and assembly, means that today’s fairings are more durable than ever, able to resist the wear and tear of real-world riding while preserving color and gloss. To readers who want a concise primer on the materials that underpin these shells, an external resource provides a straightforward overview of ABS plastic and its role in automotive and motorcycle components: https://en.wikipedia.org/wiki/ABS_(plastic). This reference is not a technical manual, but it offers a clear explanation of why ABS forms the backbone of so many aftermarket and OEM fairings, including those from Maier.

Through this lens, Maier fairings emerge as a pragmatic fusion of engineering, design, and market dynamics. The rider who selects a full shell is choosing wind protection and a unified look that can optimize aerodynamics on the highway or the track. The rider who opts for half or quarter shells is embracing the possibility of lighter weight, easier access to the bike’s lines and components, and the thrill of a more personal expression through color and graphics. The aftermarket ecosystem in Guangdong and Zhejiang makes these choices more accessible by ensuring that the shell you order can be delivered with reliability and speed, while the guaranteed fit framework on major marketplaces reduces the uncertainty that often accompanies any aftermarket purchase. In this sense, Maier fairings are not a single product but a gateway to a broader conversation about how riders engineer their machines to match their journeys. The real value, then, is not merely the shell in the box but the confidence that comes with knowing a bike can be upgraded with care, tested through miles, and reimagined with each season.

null

null

null

null

Behind the Panels: How Maier Motorcycle Fairings Navigate Global Supply Chains

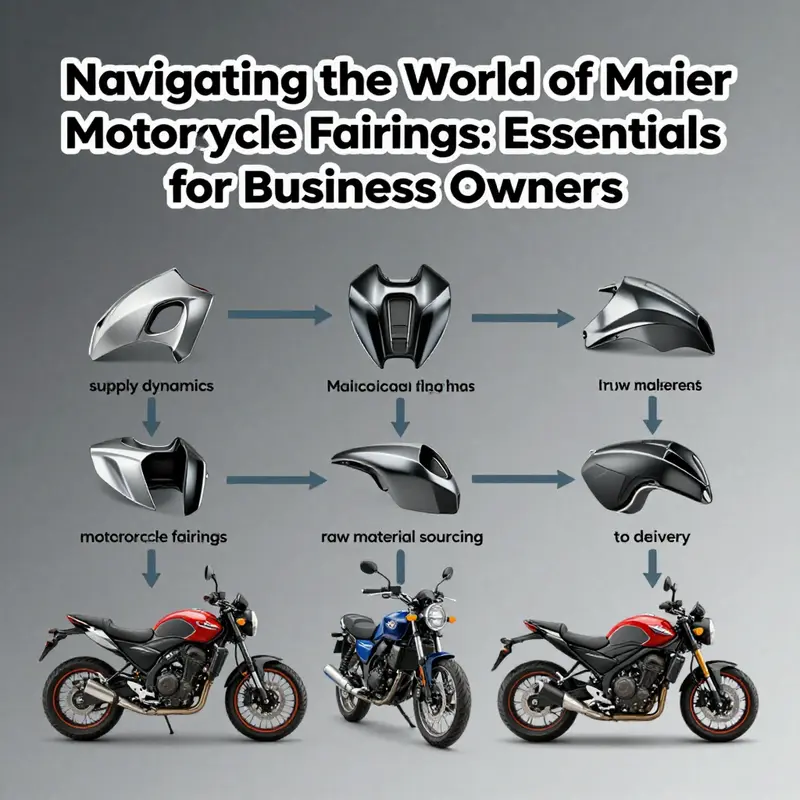

Understanding how a well-known manufacturer of motorcycle fairings moves parts from raw resin to a boxed kit on a doorstep reveals more than logistics. It reveals the trade-offs that shape cost, fit, finish, and availability. For a brand that serves riders worldwide, the supply chain is the invisible chassis that supports product consistency and competitive pricing. This chapter traces the typical flows and pressures that influence fairing production and delivery, using regional manufacturing trends and industry practices to illuminate likely dynamics for the brand.

From raw materials to finished parts, the process begins with polymer selection. Thermoplastics dominate the market because they balance weight, impact resistance, and finishability. Manufacturers choose resins for properties such as flexural strength, UV stability, and paint adhesion. These choices determine manufacturing methods. High-volume lines favor injection molding for repeatability and dimensional accuracy. Lower-volume or custom panels often come from thermoforming or hand-laid processes that allow rapid design changes. Material decisions then ripple through the supply chain: sourcing reliable resin grades reduces scrap and rework, cutting cycle times and lowering inbound inventory risk.

Geography plays a major role in fairing economics. Regional clusters in southern China, especially Guangdong and Zhejiang provinces, concentrate expertise, tooling shops, surface finishing services, and logistics providers. These clusters offer dense supplier networks that shorten lead times. When design changes occur, having a tooling house a short drive from the painting line means mold revisions and color matches happen faster. For companies serving global marketplaces, proximity to major ports is also central. Ports in southern China provide regular sailings to North America, Europe, and Australia, enabling DDP shipping options that simplify international deliveries. Clustering reduces the friction of coordination across multiple vendors and lowers the total landed cost of parts.

Vertical integration is a common strategy to control quality and margins. The most efficient supply chains combine injection molding, painting, and assembly under a single roof or within a tightly managed supplier group. This approach minimizes handling, reduces transit damage, and allows for stricter tolerances throughout finishing. It also concentrates responsibility for fitment and finish, which is vital for parts that claim guaranteed compatibility with specific motorcycle models. When thickness, fixation bosses, or mounting points deviate even slightly, fit issues ripple into customer dissatisfaction and returns. Centralized quality checks at strategic production stages catch such deviations early.

Supplier selection and buyer evaluation shape the chain as much as manufacturing choices do. B2B buyers evaluate suppliers on lead time reliability, tooling experience, surface treatment capabilities, and willingness to meet certification or testing requirements. A supplier that can deliver weather-resistant coatings and consistent paint matching gains an edge. Agile suppliers that can scale runs, provide small-batch sampling, and offer transparent QC reporting typically form the core of resilient supply networks. In practice, that means a stable interplay between in-region small specialists and larger integrators who can handle international shipping and compliance documentation.

Logistics design reflects the product’s market positioning. For a supplier focused on replacement fairings and aftermarket kits, balancing inventory buffers against transportation costs is critical. Maintaining modest safety stock in regional distribution centers shortens delivery windows for consumers. For global deliveries, many manufacturers use DDP service options to remove customs friction for buyers and to ensure predictable landed costs. However, DDP requires strong documentation practices and reliable freight partners. When a brand leverages DDP from manufacturing hubs, it limits surprise fees for the end buyer and enhances the customer experience through predictable pricing.

Quality assurance and compliance appear as continuous themes across the chain. Standard procedures include dimensional verification against CAD models, paint adhesion tests, UV exposure trials, and packaging drop tests. These steps prevent returns and protect brand reputation. For firms that emphasize guaranteed fitment, sample verification on actual motorcycle chassis or accurate fixtures is crucial. Remote verification through jigs and 3D scanning helps when physical access to every model is impractical. Traceability also matters: batch codes and production records simplify root cause analysis when defects appear in the field.

Cost structure and economies of scale influence design decisions. Large-volume runs justify expensive molds and tighter tolerances, driving down unit costs over time. For lower-volume or niche parts, manufacturers may favor cheaper tooling and flexible processes. That trade-off shows up in material thickness, finish quality, and the precision of mounting features. Brands that wish to remain competitive in price-sensitive markets must choose where to invest—premium paint and fitment testing, or lower unit costs that allow aggressive retail pricing. These decisions are rarely binary; many manufacturers run mixed strategies, offering standard lines with higher volumes and specialty items as on-demand or limited runs.

Sustainability and regulatory pressures are reshaping operations. Increasingly, buyers expect lifecycle transparency and reduced environmental impact. This motivates manufacturers to optimize resin usage, reduce solvent-based paints, and minimize waste in trimming and finishing. Locating suppliers near recycling or reprocessing facilities reduces raw material costs and waste disposal complexity. In regions with mature supplier ecosystems, environmental controls and waste management services are more readily available, which influences sourcing decisions for companies that sell globally.

Risk management is the practical counterpoint to optimization. Concentrated supplier networks offer speed and cost advantages, but they introduce geographic risk. A single coastal cluster may face weather disruptions, port congestion, or policy shifts that delay shipments. Diversification strategies include dual-sourcing critical operations, maintaining contingency inventory in different markets, or retaining secondary manufacturing partners in other regions. The goal is not to eliminate risk but to create response options that preserve service levels when disruptions occur.

For buyers and retailers, transparency within the chain is a competitive differentiator. Clear fitment claims backed by documented production and testing reduce returns and increase trust. Visible commitments to material specifications and coating processes help informed buyers choose parts that meet their riding needs and environmental conditions. Retailers that present this technical clarity alongside product listings make it easier for consumers to compare options and accept trade-offs between price and durability.

Finally, the aftermarket today is digital-first. Sales platforms require accurate SKU data, high-resolution images, and detailed fitment matrices to reduce mismatches. Manufacturers that integrate their ERP and quality databases with sales channels can automate inventory updates and provide accurate ETA information. That integration reduces overselling, supports accurate guaranteed-fit claims, and enables dynamic routing of orders to the nearest fulfillment node, optimizing delivery speed and cost.

Practical implications for anyone sourcing fairings are straightforward. Prioritize suppliers with proven finishing capabilities and reliable logistics. Confirm material specifications and ask for test records when UV stability or impact resistance matters. Evaluate the trade-offs between mold investment and part pricing for the volumes you expect. And when shopping for replacement fairings, look for vendors that offer clear fitment guarantees and documented QC processes—those investments in the supply chain show up as fewer surprises when the parts arrive and better long-term satisfaction.

For a deeper look at specific fitment lines and model categories available in the market, consult a curated collection focused on a major motorcycle make, such as the Kawasaki fairings collection linked here: Kawasaki fairings collection.

If you want a supply-chain-level profile tailored precisely to a single brand’s factories, tooling partners, or logistics providers, the most accurate next step is to review official filings, industry logistics databases, or direct supplier audits. Those sources reveal contractual structures, lead-time guarantees, and the particular mix of centralized versus distributed operations that define how a brand moves fairings from mold to market.

Shaping Identity and Performance: Customization and Aftermarket Momentum in Maier Motorcycle Fairings

Customization has become the language riders use to define their bikes, and fairings sit at the center of that conversation. For owners considering Maier motorcycle fairings, the aftermarket landscape no longer simply supplies replacement parts. It delivers opportunities to refine aerodynamics, reduce weight, express style, and integrate functional upgrades that reshape how a bike looks and performs. This chapter follows the trajectory of recent market developments so readers can understand why customization is rising, what technical and aesthetic choices matter, and how aftermarket services are evolving around brands that supply guaranteed-fit fairings.

As rider priorities shift from purely functional repairs to deliberate upgrades, the decision to replace a factory fairing becomes strategic. Riders consider urban commuting, long-distance touring, aggressive track days, and weekend customization projects differently. Each use case places distinct demands on materials, mounting tolerances, and finish. Maier’s position in the market—known for offering guaranteed-fit aftermarket fairings—means many customers approach their products not just as substitutes but as starting points for personalization. That dynamic explains why customization demand has heated up: consumers want parts that bolt on cleanly and serve as canvases for further modification.

Material choice drives the first major trade-offs. Traditional ABS plastics remain common because they balance cost, impact resistance, and paint adhesion. However, a growing segment of riders and builders are opting for lightweight composites or reinforced plastic blends to save weight and sharpen responsiveness. These materials are sought for two reasons: they reduce unsprung mass and amplify the perceived value of a build. For riders focused on performance, switching to a composite fairing can yield measurable benefits in handling stability and acceleration response, while for visually driven projects, the textured depth of modern composites elevates finish quality when paired with advanced surface treatments.

Surface treatment and printing technologies have progressed alongside materials. Water transfer printing and hydrographic techniques now allow intricate patterns—metallic weaves, faux carbon textures, and complex gradients—to wrap compound surfaces seamlessly. This technical advance matters because modern sport and naked bikes often have tightly contoured panels. Historically, such parts were difficult to finish uniformly without visible transitions. Today, those same contours become opportunities: a single-piece side panel can carry a multi-layer visual treatment that reads as factory-level custom work. These methods also reduce the barrier to entry for riders who want bespoke looks without commissioning fully hand-painted jobs.

Airflow and aerodynamics are no longer reserved for elite racing teams. Designers and aftermarket houses apply data-driven shaping—guide vanes, venting strategies, and optimized nose profiles—to consumer fairings. The objective is twofold: improve high-speed stability and manage cooling for modern powertrains. For riders who use their machines on highways or tracks, an aftermarket fairing optimized for airflow can make a noticeable difference in stability and rider fatigue. For city riders, better routing of cooling air can help manage heat in stop-and-go traffic. These functional enhancements often come integrated with cosmetic upgrades, which keeps the conversation between form and function tightly coupled.

Another emerging thread is the integration of electrical and smart features into what were previously passive panels. LED accent lighting, integrated turn-signal housings, and provisions for accessory wiring are now common on higher-end aftermarket fairings. Some advanced concept pieces even provide mounts for adjustable windshields or channels for wiring that tie into a motorcycle’s electrical system. While these features are still maturing, they demonstrate a broader shift: fairings are becoming platforms for modular upgrades rather than just shells.

Supply chain dynamics strongly influence what riders can expect from customization. A large portion of aftermarket fairings is manufactured across integrated clusters that can respond rapidly to design iterations. That agility shortens lead times for new finishes and allows domestic retailers to offer a wider range of fitments and styles. For brands supplying guaranteed-fit options, this capacity means customers can buy with confidence that a fairing will meet their make and model without extensive modification—an essential baseline when personalization is the next step.

Service infrastructure has also evolved to support the customization trend. Installation professionals now commonly offer matched painting, seam-filling, and precision alignment alongside mechanical mounting. This full-service approach helps prevent common pitfalls—paint mismatch, improper fastener torque, or misaligned panels—that can erode the perceived quality of a custom job. For riders who want to DIY, many manufacturers and vendors publish detailed guides and kit-specific instructions, reducing the risk associated with a home installation.

Economics play an outsized role. Cost-conscious riders often prioritize options that yield the most visible impact per dollar. In that respect, switching to a stylish aftermarket fairing with an attractive finish frequently offers more immediate satisfaction than more expensive internal upgrades. At the same time, a growing number of riders view certain fairings as investments: a durable, well-finished panel extends the service life of a bike’s exterior and preserves resale value. In short, customization can be framed both as aesthetic enhancement and as a practical, value-preserving choice.

Compatibility and fitment remain decisive factors, particularly for riders who want to avoid costly adjustments. A guaranteed-fit offering reduces uncertainty and provides a reliable foundation for customization. When fitment is assured, the rider can focus on surface finishing, accessory integration, and minor trim changes rather than structural modifications. This is particularly helpful for models that have complex mounting points or tight tolerances between subframes and panels. To explore model-specific aftermarket categories and see the variety of fitments available for popular platforms, consider browsing fairing options such as those for sport and touring lines, which illustrate how targeted fitment catalogs support customization choices: fairings-for-yzf.

Regulatory and safety considerations also shape custom choices. Lighting modifications and aerodynamic adjustments can affect legality and the safety profile of a bike. Responsible customization balances creative goals with compliance and operator safety. Professional installers and reputable vendors help navigate local regulations for lighting and reflectivity, while ensuring that structural integrity is not compromised by aftermarket fasteners or ad hoc mounts.

Finally, community influence cannot be understated. Builders, clubs, and online forums accelerate innovation by sharing successful techniques and showing what works visually and mechanically. The feedback loop between riders and manufacturers is now rapid: trends observed in social channels often translate into new finishes or molded features in the next product cycles. For brands that offer broad fitment ranges and support guaranteed compatibility, this communal feedback becomes a competitive advantage. It enables faster refinement of molding tolerances, finish standards, and accessory compatibility.

Taken together, these forces point to an aftermarket that is increasingly sophisticated. For riders considering Maier fairings, the message is clear: choose a platform with reliable fitment and then consider materials, surface treatments, aerodynamic details, and installation services as the levers that will shape your result. The aftermarket offers more than replacement parts; it opens a path to a bike that performs and presents according to the rider’s priorities. For those seeking a deeper exploration of modern customization techniques and market trends, industry analysis and practical guides remain helpful resources: https://www.motorcyclecustomization.com/guide-to-custom-motorcycle-fairings-2025

Final thoughts

Understanding the landscape of Maier motorcycle fairings is vital for business owners in the motorcycle industry. With diverse types to cater to varying rider preferences, choice of materials affecting durability and cost, and the deeper economic impacts tied to manufacturing, the importance of fairings cannot be overstated. Furthermore, the intricate supply chain dynamics highlight the efficiency with which these products reach their markets. Coupled with the rising trends of customization and aftermarket enhancements, Maier motorcycle fairings present a rich opportunity for innovation and business growth. The insights gathered here equip business owners with the necessary knowledge to navigate this vibrant sector effectively.